In our FAQs, we're going to review:

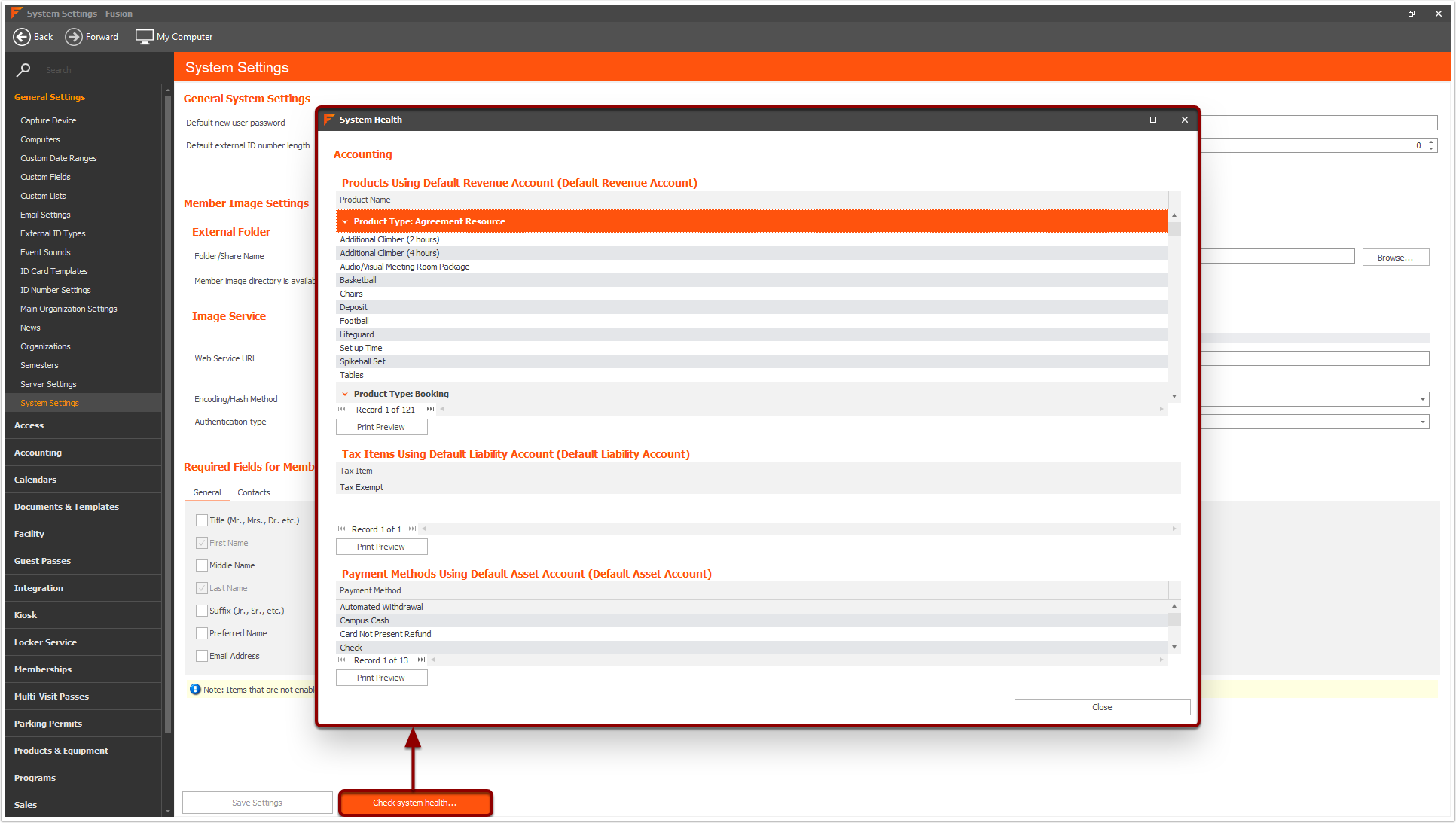

Are there any checks I can do to see if all my items have GL Accounts attached to them?

What is the difference between a refund, a void, and a payment reversal?

Refunds

Imagine a customer purchases a costume they no longer like...they want to return it...AND they want their money back. That's where refunds come into play!

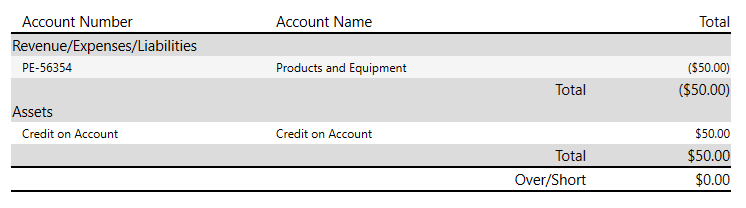

When you refund, there will be a new transaction that debits the revenue account and credits the asset account.

Voids

Voids are essentially saying “we want to pretend this didn’t happen.” It’s like going ghost! These should be used when you want to fully remove the history in Fusion, such as when an order was done in error. These are rare and are usually reserved for Admin permissions only.

When you void something in Fusion, it fully removes the record from Chart of Accounts. You can still see the transaction’s history, and the voided label for it, in the Financials tab within a Member Record. Voiding cannot be undone.

When you void something in Fusion, it fully removes the record from Chart of Accounts. You can still see the transaction’s history, and the voided label for it, in the Financials tab within a Member Record. Voiding cannot be undone.

Payment Reversals

You drop candy to an eager trick-or-treater, but it accidentally falls to the ground. Oh no! You still owe them that candy.

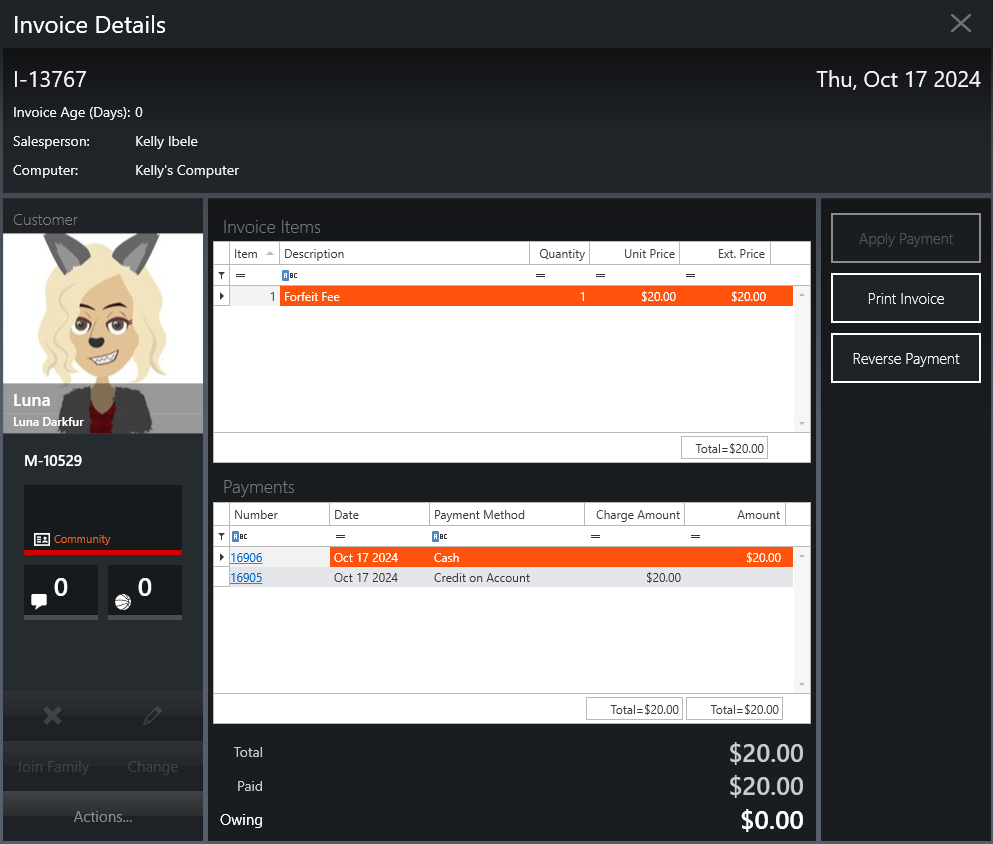

A payment reversal works similarly by returning the invoice to an owing status. A common situation where you might use this is when a customer's check bounces. You already marked the invoice as paid by check, but you never actually received the money since it bounced! You can go to that invoice and select Payment Reversal to put the invoice back to owing.

When you select Payment Reversal, the asset account is credited and the Credit on Account (or Accounts Receivable) asset account is debited, ensuring everything is balanced in your sweet haul.

A payment reversal works similarly by returning the invoice to an owing status. A common situation where you might use this is when a customer's check bounces. You already marked the invoice as paid by check, but you never actually received the money since it bounced! You can go to that invoice and select Payment Reversal to put the invoice back to owing.

When you select Payment Reversal, the asset account is credited and the Credit on Account (or Accounts Receivable) asset account is debited, ensuring everything is balanced in your sweet haul.

Why are my reports not matching?

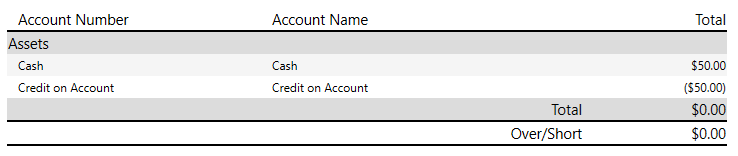

When you invoice a customer, Credit on Account gets debited on the day of the invoice. They might not pay off that invoice until a later date.

In most Accounting Reports, you'll see the Credit on Account debit amount on the invoice date. The Credit on Account debit amount would balance the Revenue Account's credit amount, as shown below.

In most Accounting Reports, you'll see the Credit on Account debit amount on the invoice date. The Credit on Account debit amount would balance the Revenue Account's credit amount, as shown below.

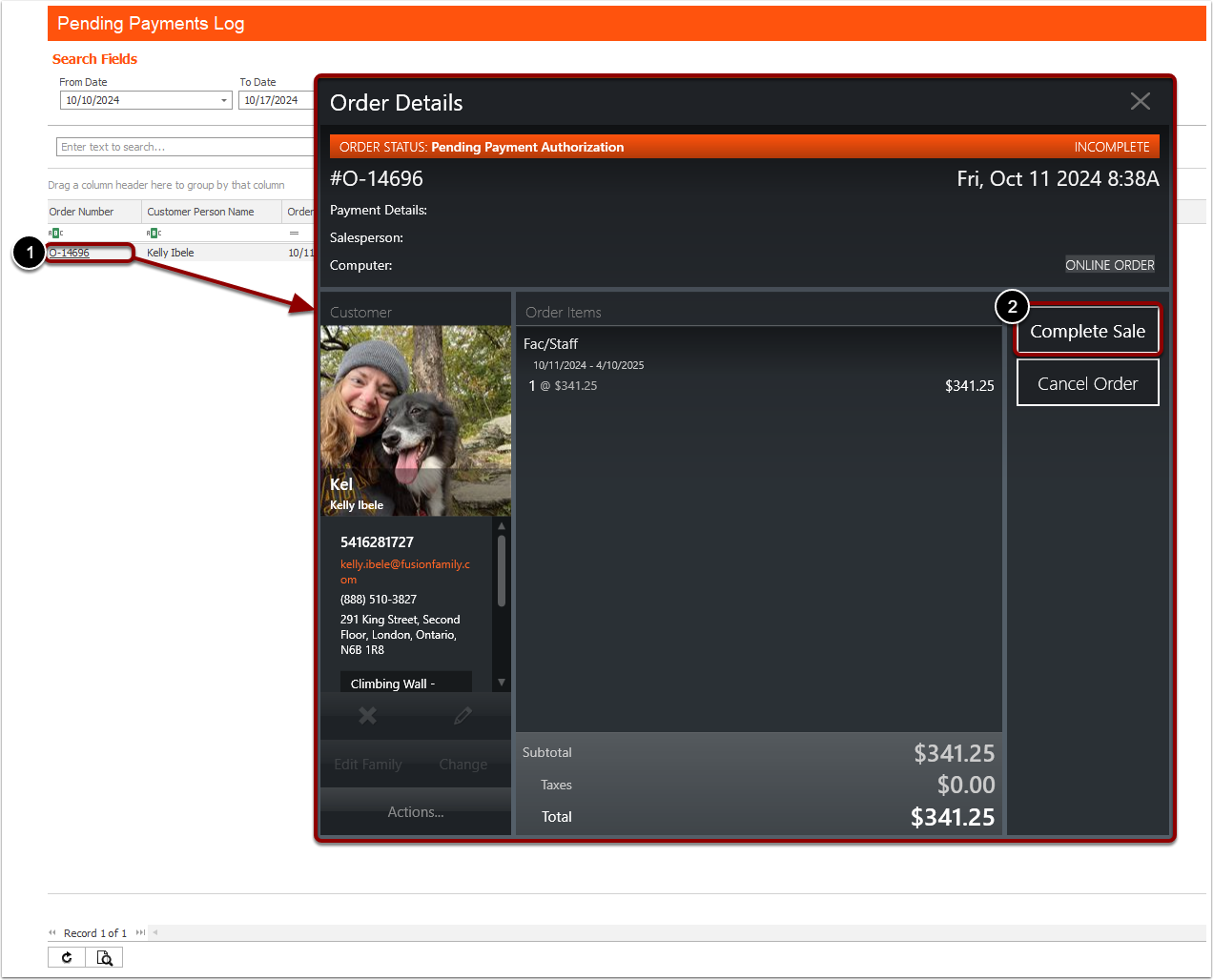

I see a history of payment through my Payment Processor, but that order is not showing in Fusion. How can I find it?

Remember to check the Pending Payments Log, a place where unfinished transactions linger. You can view the Pending Payments log my navigating to System Preferences > Accounting > Pending Payments Log.

Wondering why an order might be trapped in the Pending Payments Log? This will happen if Fusion doesn't receive a response from the Payment Processor within 20 minutes of the order's creation. This eerie occurrence might happen due to a variety of frightful factors, including a flickering internet connection or a member pressing the back button or exiting the page before the transaction has completed.

Wondering why an order might be trapped in the Pending Payments Log? This will happen if Fusion doesn't receive a response from the Payment Processor within 20 minutes of the order's creation. This eerie occurrence might happen due to a variety of frightful factors, including a flickering internet connection or a member pressing the back button or exiting the page before the transaction has completed.

What's the difference between Credit on Account and Money in Account?

Credit on Account

Credit on Account is an asset tied to Accounts Receivable, representing the haunting amounts that customers owe you! Whenever you invoice a member, you'll see the invoice as "paid" by Credit on Account. However, don't be fooled! This doesn't mean you've actually captured the funds!

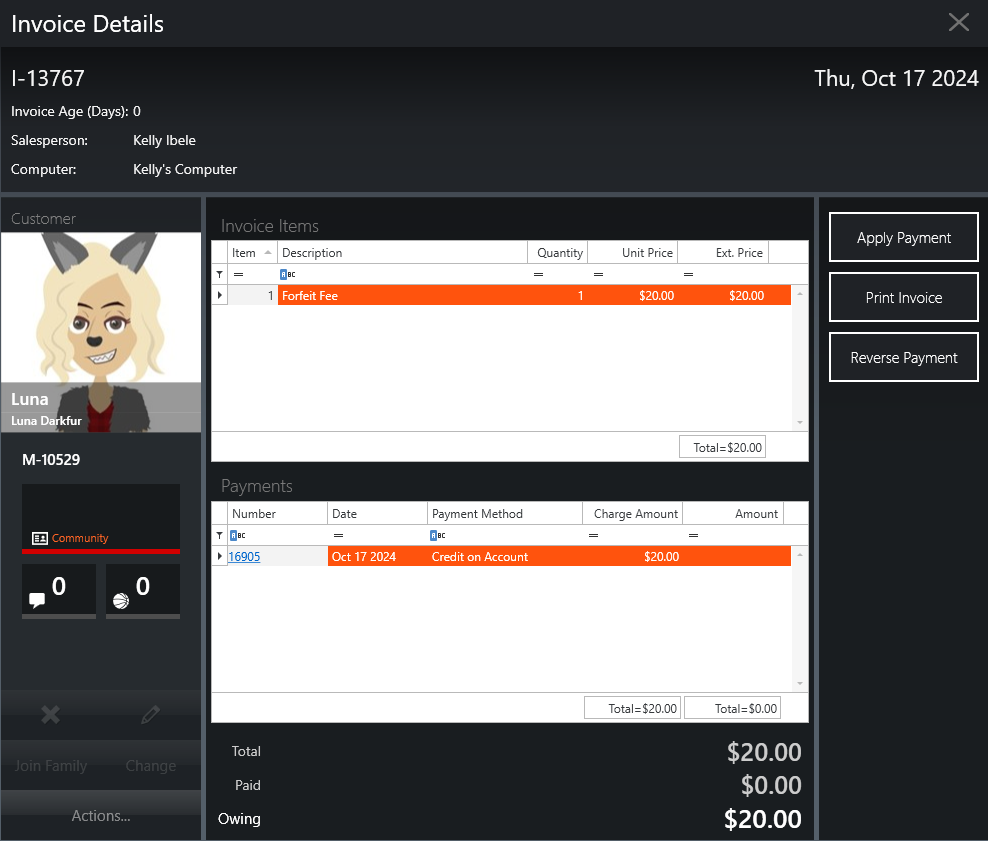

Let's say Luna Darkfur is invoiced for a Forfeit Fee. You'll see a line item for "Credit on Account" in the Payments section. This is to ensure there is an equal debit and credit, maintaining balance for Fusion's Accounting. If you only see Credit on Account listed as the payment method, it indicates that Luna is still haunted by an outstanding debt of $20.00!

Let's say Luna Darkfur is invoiced for a Forfeit Fee. You'll see a line item for "Credit on Account" in the Payments section. This is to ensure there is an equal debit and credit, maintaining balance for Fusion's Accounting. If you only see Credit on Account listed as the payment method, it indicates that Luna is still haunted by an outstanding debt of $20.00!

Money in Account

Write your awesome label here.

Thanks for joining us!

Come back next week for our last blog of the Halloween Accounting series, where we'll review Reporting options!