We know that accounting can be a bit terrifying at times, but fear not! This Halloween season, we invite you to join us for a thrilling three-part blog series that will unravel the mysteries of accounting in Fusion.

In this eerie expedition, you can uncover:

In this eerie expedition, you can uncover:

- A Ghostly Guide to Accounting in Fusion: Learn about our accounting system and discover how to navigate this haunted landscape with ease.

- Fright-free FAQs: We'll address your most spine-chilling questions and share clever tricks to help you conquer your accounting fears!

- Eerie Insights: You'll learn more about recommended accounting reports and what information you can gather from Fusion.

A ghostly guide to Accounting in Fusion

In our ghostly guide today, we're going to review:

Fusion Accounting Methods

It's all about balance...

It's a costume party!

Let's meet the types of GL Accounts...

Asset Accounts

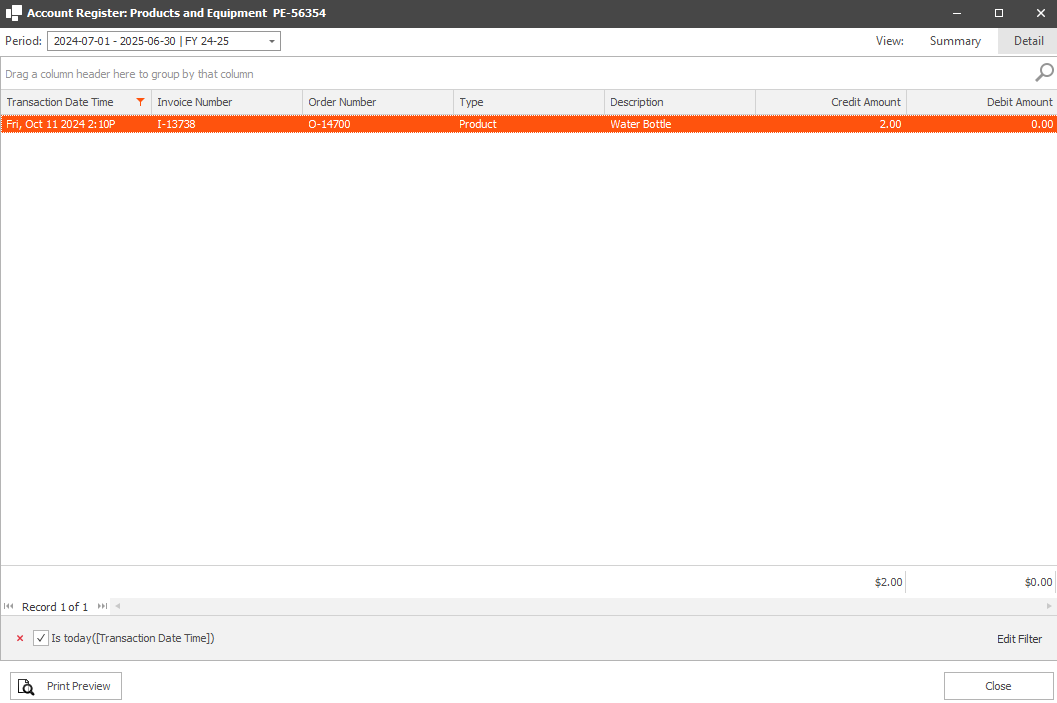

Revenue Accounts

Liability Accounts

Expense Accounts

Last but not least...let's talk about some main characters in Fusion Accounting.

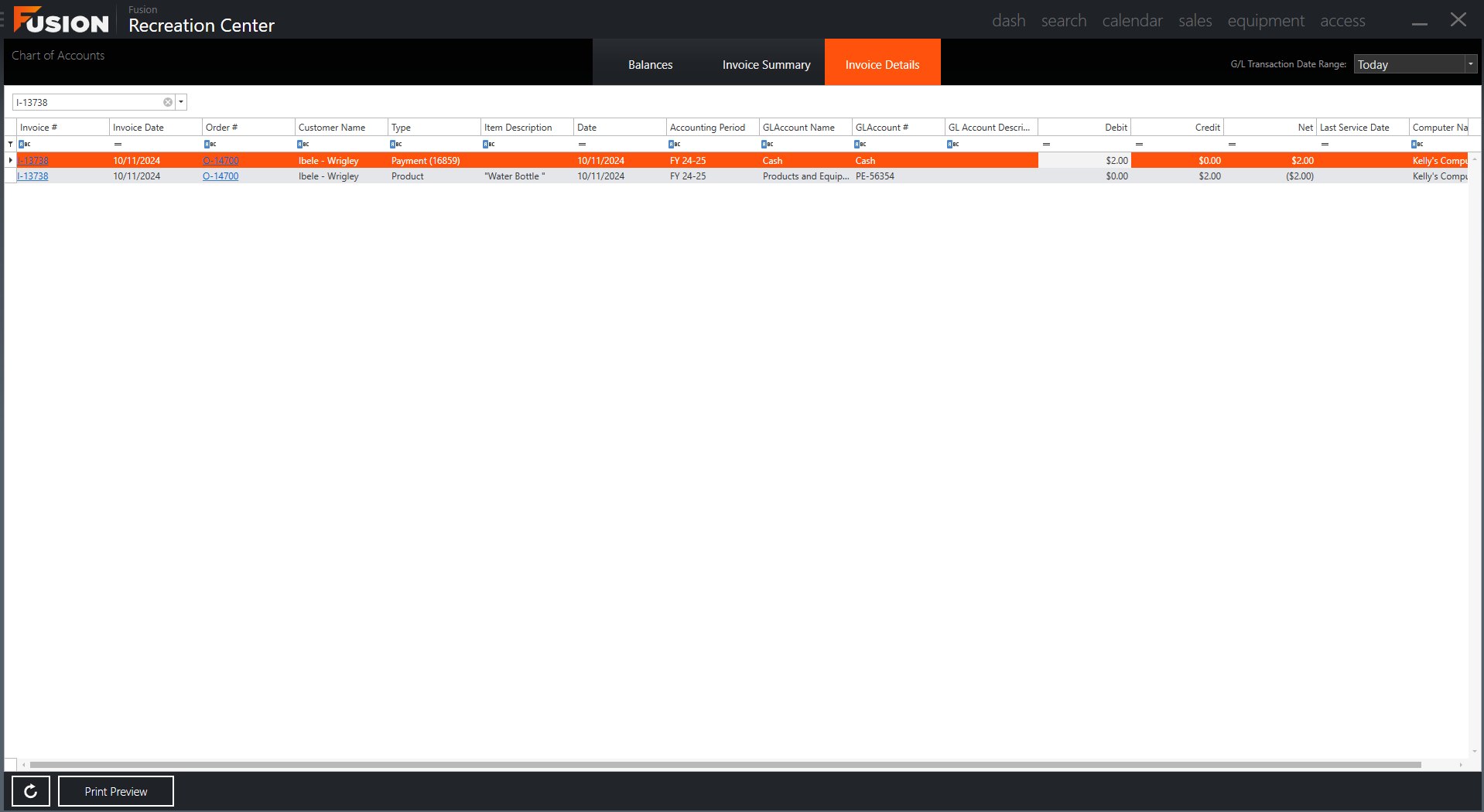

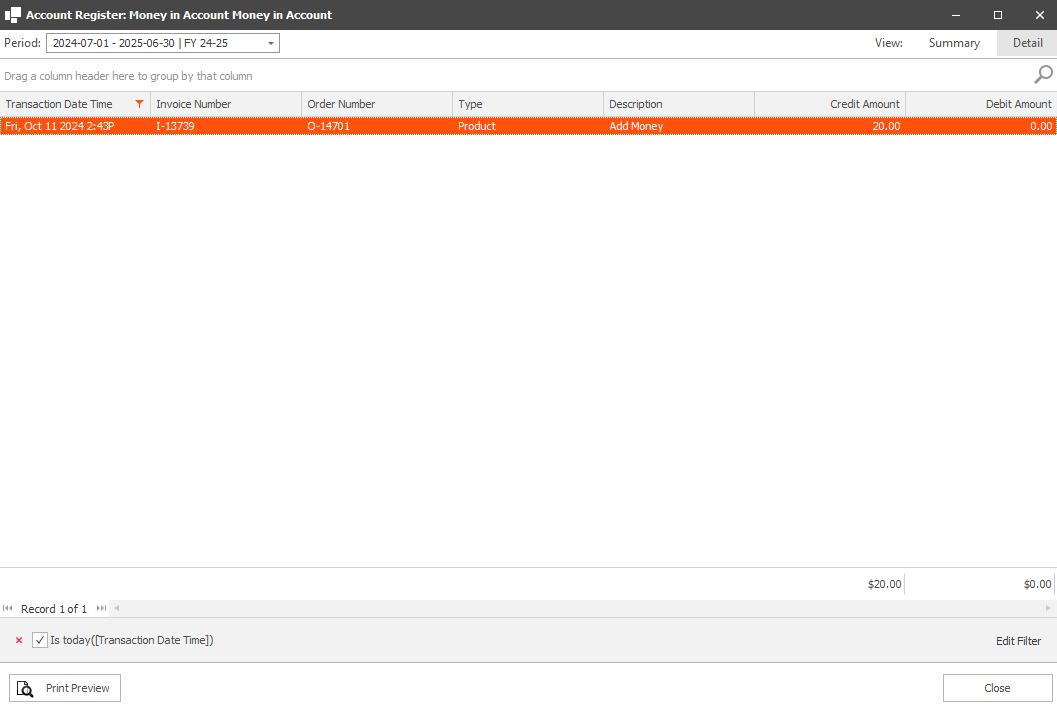

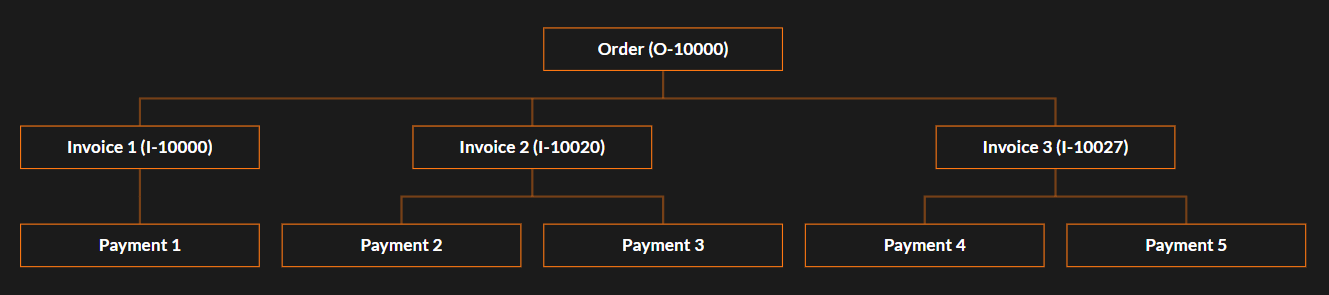

Orders (O-#)

One is created for every transaction, regardless of if there's a cost.

The order is created when the transaction takes place.

The order is created when the transaction takes place.

Invoices (I-#)

At least one is created for every transaction.

The invoice is created when generated in Fusion.

The invoice is created when generated in Fusion.

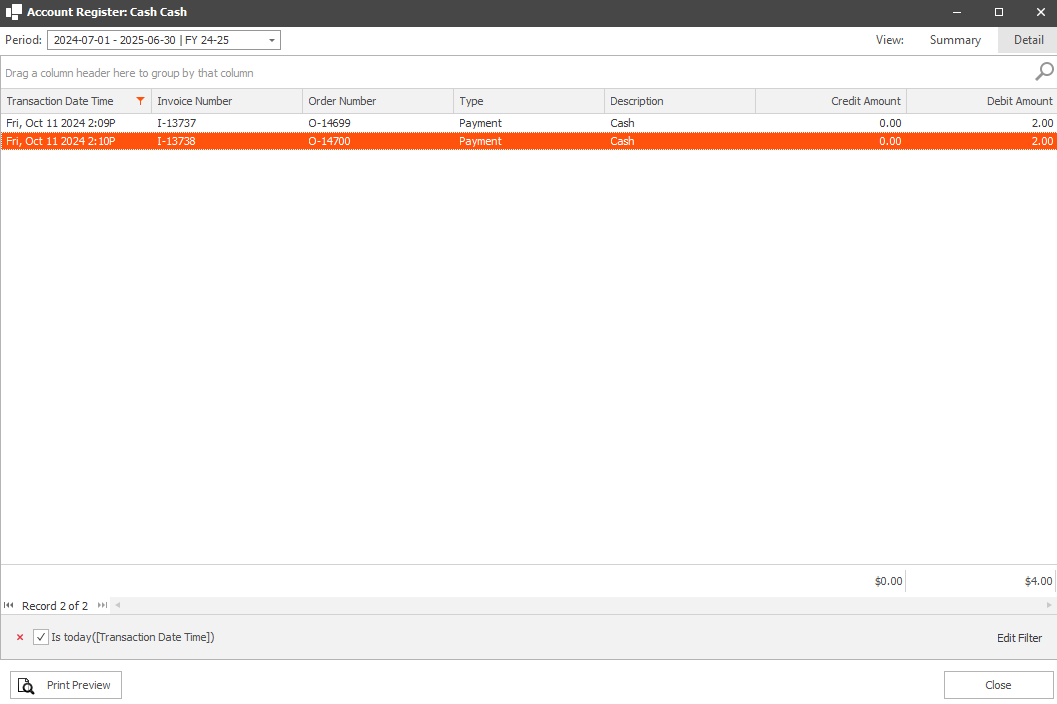

Payments (P-#)

At least one per transaction.

The payment is created when a payment is made on an invoice.

The payment is created when a payment is made on an invoice.

Phew! That was a lot of Accounting information...

Take a break, maybe grab some candy, and get ready for our next Accounting Post: Fright-free FAQs!

Take a break, maybe grab some candy, and get ready for our next Accounting Post: Fright-free FAQs!